Expertise

Your tax consultant for Amazon FBA

"Whether you are a new start-up or an already established online retailer - as a tax consultant for Amazon FBA, we take care of your complete financial accounting, including annual financial statements, advance sales tax returns and tax returns.

In doing so, we advise you in a proactive and individual manner, know all the tax requirements of the various fulfillment programs and accompany you holistically in cross-border online trade with Amazon as part of our all-in-one solution. Engage one of the best in business for your taxes."

Subject to your consent, Amazon may, in order to shorten delivery times and save storage costs, distribute your goods to existing logistics centers abroad and sell them locally. Already when the goods are shipped abroad, a sales tax registration must be provided in order to save unnecessary costs. The storage of goods is subject to VAT in each country. If the delivery threshold of €10,000 is exceeded, sales abroad are also subject to VAT. Registration for the OSS procedure can simplify matters.

Regardless of how, our tax experts will review your individual case and advise you in detail and individually on your options - always with the aim to minimize your tax burden.

Full service tax consultancy

Our basics

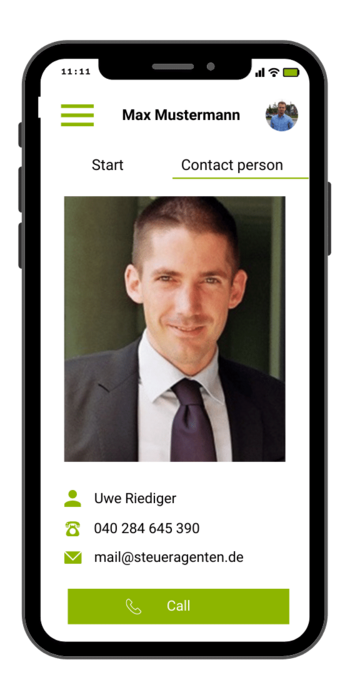

- Digital tax office: Everything at a glance any time via app.

- Digital bookkeeping: Everything at your fingertips in the cloud.

- Annual report and tax returns: Clean solutions.

- Personal contacts: For questions, tips and information.

- Regular conversations: By phone or face to face.

- Highest data security: Guaranteed by strong partners.

- Tax consultancy change service: We’ll take care of it.

Reliable & time-efficient

We make things as easy as possible for you. To do that, we use our consulting expertise in addition to a wide range of software solutions that simplify your processes. Our goal is always to reduce your workload and provide you with the best possible, sustainable and reliable support.

Individual services

We know how to be individual! Our tax consulting team is complemented by software experts. With their help, we can create individual interface solutions for our clients if necessary. Modern and personal tax consultancy must be as flexible as life itself. We always provide exactly those services our clients need at the time.