Expertise

Tax consultant for e-commerce

“As specialised tax advisers for e-commerce, our experienced team is excited about supporting large and small online retailers, from choosing the right legal form all the way to automating their financial accounting. Your business is in good hands.

Our industry focus and tax expertise combined with IT know-how make us unique in the field of e-commerce tax consulting. We advise you on all tax issues surrounding online shops, online retailing and special issues like drop shipping, Amazon FBA or multi-channel solutions.”

We already support over 1.000 e-commerce companies. You can benefit from our enormous knowledge advantage and experience. We know all the pitfalls in e-commerce and have either successfully solved them or are currently working on them.

We are a proven specialist and interface expert. Whether consulting, financial accounting or annual financial statements - we take care of it.

Full service tax consultancy

Our basics

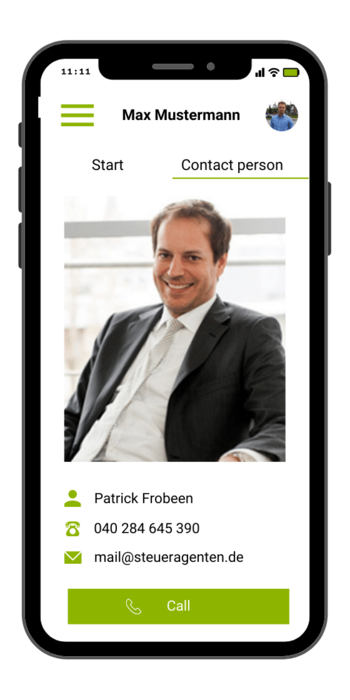

- Digital tax office: Everything at a glance any time via app.

- Digital bookkeeping: Everything at your fingertips in the cloud.

- Annual report and tax returns: Clean solutions.

- Personal contacts: For questions, tips and information.

- Regular conversations: By phone or face to face.

- Highest data security: Guaranteed by strong partners.

- Tax consultancy change service: We’ll take care of it.

Frequently asked questions

Can you provide tax support for the PAN-EU program?

Which declarations or tax returns must be submitted abroad?

Can you monitor delivery thresholds?

What happens if I exceed a delivery threshold?

What are the possibilities of the sales tax option?

Do I need to connect my merchandise management system to the tax office?

What are the advantages of dropshipping?

Dropshippers offer products in their online store without having them directly in stock. This allows the start with a small amount of capital. In addition, one saves high storage and administration costs. For many newcomers in e-commerce, dropshipping offers the opportunity to test the market and establish themselves as an online retailer with little effort. However, tax issues can sometimes turn out to be complex, especially when shipping internationally. Our experienced tax advisors are available to advise you and help you avoid tax pitfalls in dropshipping.