Expertise

VAT Compliance in Germany

"Do you run a company abroad and perform deliveries or services in Germany? Are you obligated to complete VAT Compliance in Germany? Our experienced tax experts will support you throughout the registration process and are also available to answer any questions you may have."

Basics - Services

For your e-commerce

- Cloud platform including document archive to complete the process

- Application for VAT ID and tax number

- Application for a certificate according to Section 22 f UStG (VAT Act)

- Support with ongoing tax obligations in Germany

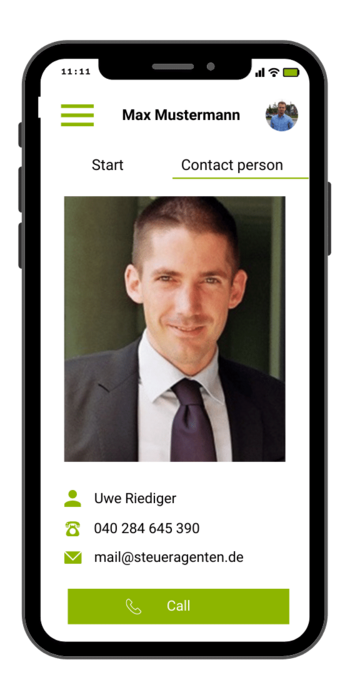

- Personal contact for all questions

- Assistance with required forms and documents

- Preparation of monthly VAT advance notifications

- Preparation of the annual VAT declaration

Tax registration

€500 one-time

Tax registration in Germany including contact person for questions during the registration process:

- Application for VAT ID

- Application for a German tax number

- Application for a certificate according to Section 22f UStG (VAT Act)

- Personal contact person

- Support with required documents

- Access to the digital tax office (cloud platform)

Ongoing support

from €1,000 annually

Ongoing support of e-commerce companies for VAT compliance in Germany:

- Contact person for queries from the tax office in Germany

- Monthly or quarterly VAT advance notifications

- Annual VAT declaration

- Personal contact for questions

- Access to the digital tax office (cloud platform)

- Up to 10 incoming invoices per month

- Up to 2 automatically connectable sales platforms (e.g. amazon)

Do-it-yourself

Where can I get a tax number in Germany?

The tax office where you must apply for your tax number depends on where your company is located. On this page, you will find a list of states and the relevant tax office. In the next step, you inform the tax office that you will be or are liable for tax in Germany. To do this, enclose your state-specific company certificate and your company's bank details. You will then be sent a document requesting additional data and information on you and your company.

What do I have to register for tax purposes in Germany?

There are several constellations that require you to register for tax purposes in Germany. The most common cases concern companies from abroad that

- maintain a registered office or a permanent establishment in Germany or

- for example, as an online retailer, store goods in a warehouse in Germany or

- deliver goods to Germany and assume the import or

- provide services in Germany (without transfer of tax liability according to Section 13b UStG [VAT Act]).