Expertise

Your tax consultant for startups

"As a competent tax consultancy for startups, we support founders along their way to a successful company with all tax and business issues. You can focus on your actual job as founder of a startup: building your company.”

Questions

Common challenges faced by startups

- Preparing a business plan

- Best choice of legal form

- Checking for possible funding opportunities

- Outsourcing of financial and payroll accounting

- Professional documentation for third parties (e.g. investors, banks, funding agencies)

- Projection of the effects of financing alternatives

- Preparing planning calculations

Solution

We offer answers and solutions

We work with you in a structured process to analyse your founding endeavour and point out the opportunities, problem areas and solutions. We always keep the success of your startup in mind and give you not only valuable tips and our experience with a wide range of industries, but also this: The certainty of handling tax issues the right way and not being left alone with your questions.

Full service tax consultancy

Our basics

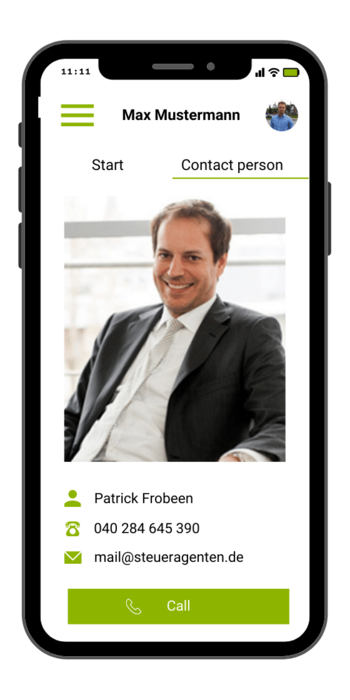

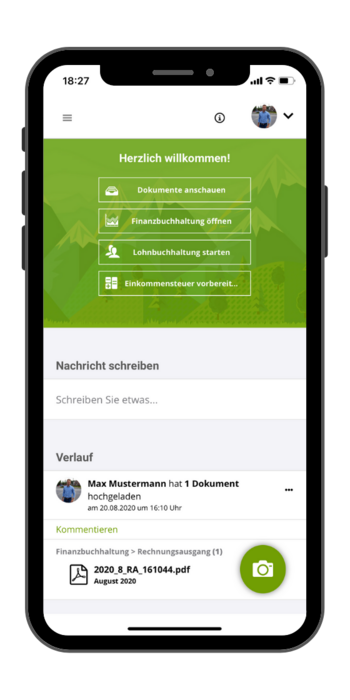

- Digital tax office: Everything at a glance any time via app.

- Digital bookkeeping: Everything at your fingertips in the cloud.

- Annual report and tax returns: Clean solutions.

- Personal contacts: For questions, tips and information.

- Regular conversations: By phone or face to face.

- Highest data security: Guaranteed by strong partners.

- Tax consultancy change service: We’ll take care of it.

Initial consultation

Flat fee EUR 150 plus VAT

We conduct an initial consultation with you (max. 1.5 hours) to discuss the essential points of your founding idea. For example: choice of legal form, tax obligations, accounting, optimal structure, expert assessment, support options, registrations, location, financing.

We understand founders.

You too can benefit from our tax experts’ many years’ experience with advising startups. Our firm is particularly fond of founders. We have already successfully advised and supported a number of successful entrepreneurs with starting their companies. Our tax consultants for startups have a wealth of experience to draw from.

Benefits of the digital tax office

Being free. Being digital.

The digital tax office is a future-oriented cloud solution which offers our clients maximum freedom when it comes to tax issues. Services like payroll accounting, annual balances and tax returns are processed most efficiently.

Using an app on your smartphone, tablet or in your browser, you can submit invoices and receipts conveniently from anywhere, anytime and with encryption. Our tax experts do the rest.