Expertise

Your tax consultants for freelancers

"As tax advisers for freelancers, our goal is to have your back so you can concentrate on the essentials: your work. We take care of your accounting, prepare your tax return, and are just a phone call away whenever you have questions about your freelance activities. Reliable, creative, and almost always cheerful."

Challenge

Common questions by freelancers

- Preparing a business plan

- To outsource your financial accounting or to do it yourself

- Travel expenses, vehicle and invoicing

- Professional documentation for third parties (e.g. banks, lessors)

- Tax prepayments and planning

- Options for tax optimisation

- Net income method and income tax return

- VAT ID, summary statement and invoices to other countries

- Artist’s social security fund and retirement

Tax consulting tailored to freelancers.

Submit receipts and invoices easily and conveniently. Done! We take care of the rest. We prepare your net income calculation, take care of your taxes and accounting, optimise, inform and communicate with the financial authorities. You can concentrate on your work without a worry.

Whether you are freelancing in the scientific, medical, artistic, writing, teaching or any other area: we understand the specific requirements of your field. Benefit from our extensive experience with freelance professions.

Full service tax consultancy

Our basics

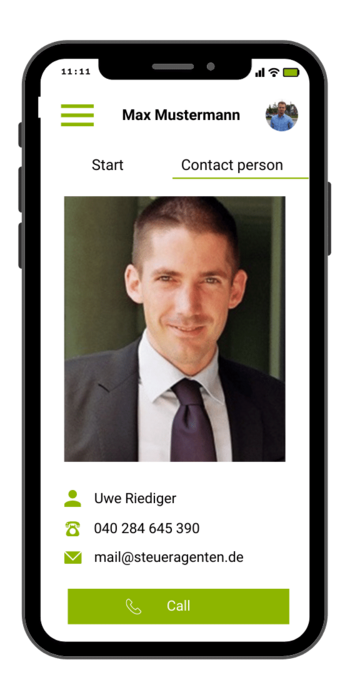

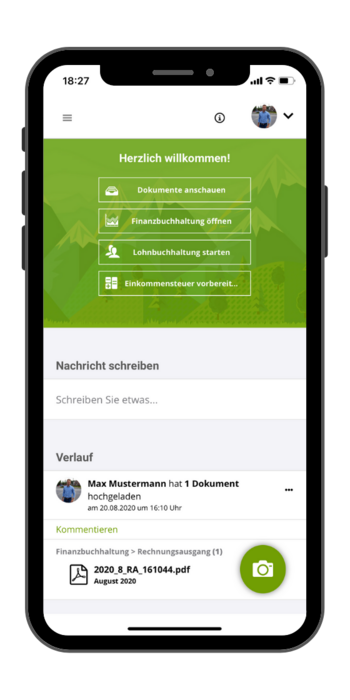

- Digital tax office: Everything at a glance any time via app.

- Digital bookkeeping: Everything at your fingertips in the cloud.

- Annual report and tax returns: Clean solutions.

- Personal contacts: For questions, tips and information.

- Regular conversations: By phone or face to face.

- Highest data security: Guaranteed by strong partners.

- Tax consultancy change service: We’ll take care of it.

Digital accounting

starting from € 80 per month

Digital, reliable and accurate. Spare yourself the monthly hassle of poorly functioning tax or accounting programmes. One of our standard services is financial accounting compliant with all legal requirements. In addition, we inform you of legislative changes and are always at hand to answer all of your question.

Benefits of the digital tax office

Being free. Being digital.

The digital tax office is a future-oriented cloud solution which offers our clients maximum freedom when it comes to tax issues. Services like payroll accounting, annual balances and tax returns are processed most efficiently.

Using an app on your smartphone, tablet or in your browser, you can submit invoices and receipts conveniently from anywhere, any time and with encryption. Our tax experts do the rest.