Expertise

Tax consultant for your holding

"Do you own several companies? As tax advisers for holding companies we adjust to your individual needs and handle all of your tax issues meticulously and conscientiously.

steueragenten.de has a team of enthusiastic tax experts who love their job. Likeable contact persons, professional expertise, training specifically for holding structures and quality assurance are all part of the package. We provide top-notch advice, transparently and reliably, without a lot of red tape. We also continuously develop our own software solutions, optimise interfaces to third-party systems and passionately work on “tax consulting for the future”.

Full service tax consultancy

Our basics

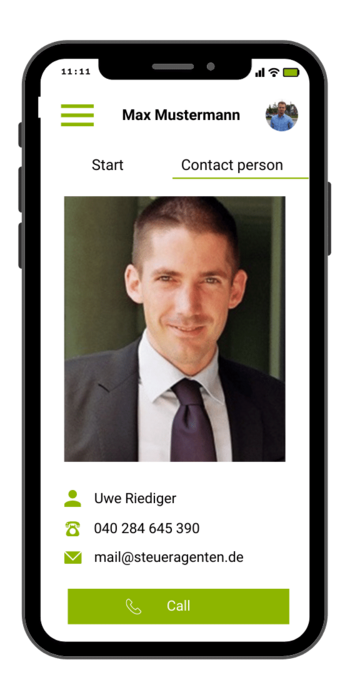

- Digital tax office: Everything at a glance any time via app.

- Digital bookkeeping: Everything at your fingertips in the cloud.

- Annual report and tax returns: Clean solutions.

- Personal contacts: For questions, tips and information.

- Regular conversations: By phone or face to face.

- Highest data security: Guaranteed by strong partners.

- Tax consultancy change service: We’ll take care of it.

Common questions

When does it make sense to found a holding?

What is it like to work with a holding structure?

Whether UG, GmbH or AG: We adjust to your individual needs. We spare you not only the annoying trip to your tax adviser’s office, but also the time-consuming chore of sorting out your paperwork. Communication and encrypted data transfer are a snap through the app.

Accounting chores can drive a person to distraction. Not so if they work with us. Because we take those chores off their hands. Our team consists of superbly trained tax advisers, tax experts and qualified tax clerks. Frequent errors because of a lack of knowledge? Not with steueragenten.de. A tax adviser who not only takes care of the “paperwork” but also thinks like an entrepreneur? We check where our clients can realise savings smartly and legally.