Expertise

Tax consultant for your UG

"As tax consultants for UGs, we are the experts on all of your tax issues. We know how efficient accounting can help a company to succeed.

Founding a UG initially involves a mountain of bureaucracy. And even when the company is up and running, the amount of paperwork doesn’t really get any less. With our specially developed digital tax office, we offer you a smart solution for having competent tax consulting at your fingertips any time. That means for you: top-notch tax consulting with less effort. Anytime. Be it via app, tablet or browser. You can transfer your invoices and receipts easily and securely to the cloud from wherever you are. We do the rest.”

Full service tax consultancy

Our basics

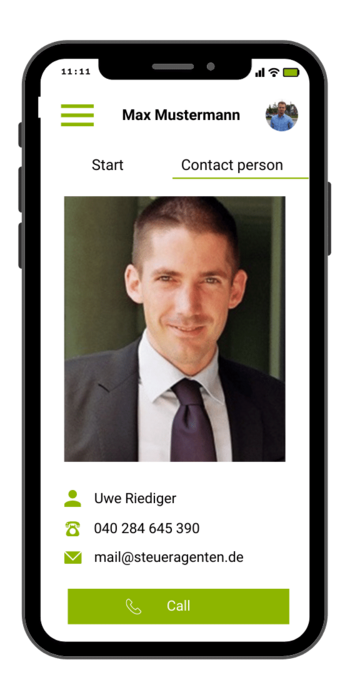

- Digital tax office: Everything at a glance any time via app.

- Digital bookkeeping: Everything at your fingertips in the cloud.

- Annual report and tax returns: Clean solutions.

- Personal contacts: For questions, tips and information.

- Regular conversations: By phone or face to face.

- Highest data security: Guaranteed by strong partners.

- Tax consultancy change service: We’ll take care of it.

Common questions

What is the ideal accounting system for a UG?

Our digital tax office is a future-oriented cloud solution that offers our clients maximum freedom when it comes to tax issues. Your UG has full access to your figures, data and analyses that not only provide business information but also help you with investment questions. Via the digital tax office, services like payroll accounting, annual balances and tax returns are processed most efficiently.

Using an app on your smartphone, tablet or in your browser, you can submit invoices and receipts conveniently from anywhere, anytime and with encryption. Our tax experts do the rest. Questions, concerns and pro-active consulting: We support our clients in person with a permanently assigned contact person - by telephone or face to face. This is how easy tax consulting can be!

I am not satisfied with my tax advisor. Can I switch to your services any time?

Generally, yes. If you no longer have the right chemistry with your tax consultant, you should switch. According to Section 627 of the German Civil Code, you can cancel your mandate with your tax advisor at any time without prior notice, unless you have established a long-term contract; in that case, you must adhere to the agreement.

Your contract with steueragenten.de can be severed any time by either side. As soon as you decide to switch to us, we ensure a trouble-tree transition. We schedule an initial meeting where you provide your personal contact with current information. If you authorise us, we also handle the change of tax advisor with the financial authorities. Other questions? Find out how you can switch to steueragenten.de.